Project type: Self-directed

Brief sponsor: Barclays Bank

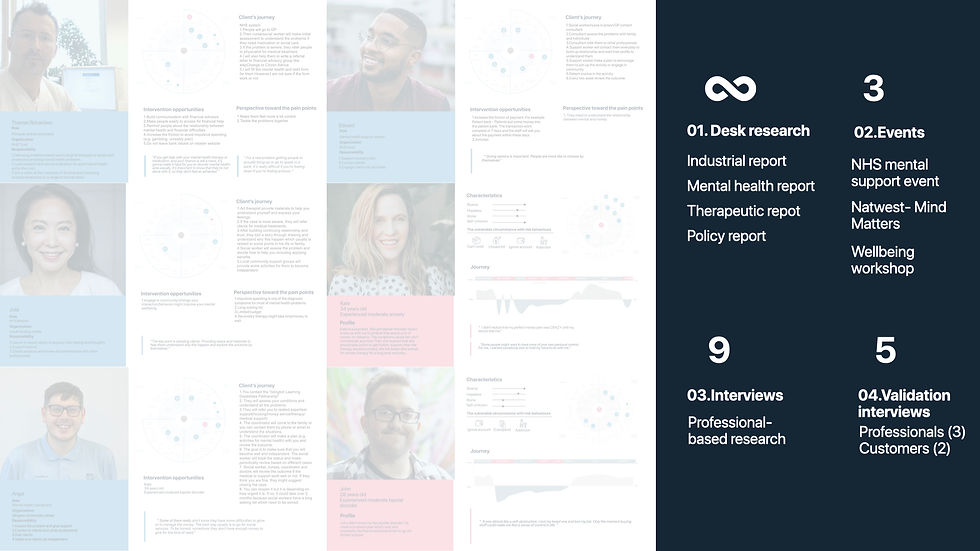

Design tool: Online Interview, Professionals-based research, Persona, User journey, Stakeholder map, HMW, Service blueprint, Wireframe, Sketch app, Adobe XD

Background

This project came from the brief sponsored by Barclays from D&AD. On the macro level, Mental health problems is a challenge for everyone. In the UK, 1 in 4 people might experience a different degree of mental health problem in their life. Also, they are 3.5 times more likely to be in problem debt than those without mental health problems.

Owing to the intricate link between money and mental health, it might become a vicious circle that is hard to escape. In this brief, we aim to explore how digital service design can help their customers, who suffer from different degrees of mental health issues to better manage their money.

“It was almost like a self-destructive. I lost my loved one and lost my job. Only the moment buying stuff could make me feel a sense of control in life. ”

- Expert by experience, with bipolar disorder

“Getting people to actually bring up or go to speak to a bank is really difficult if you're feeling anxious. There's very little communication between NHS mental service and financial advice service. So that's the problem that some people can drop between them.”

- Dr. Thomas Richardson, Principle clinical physicalist

Problem

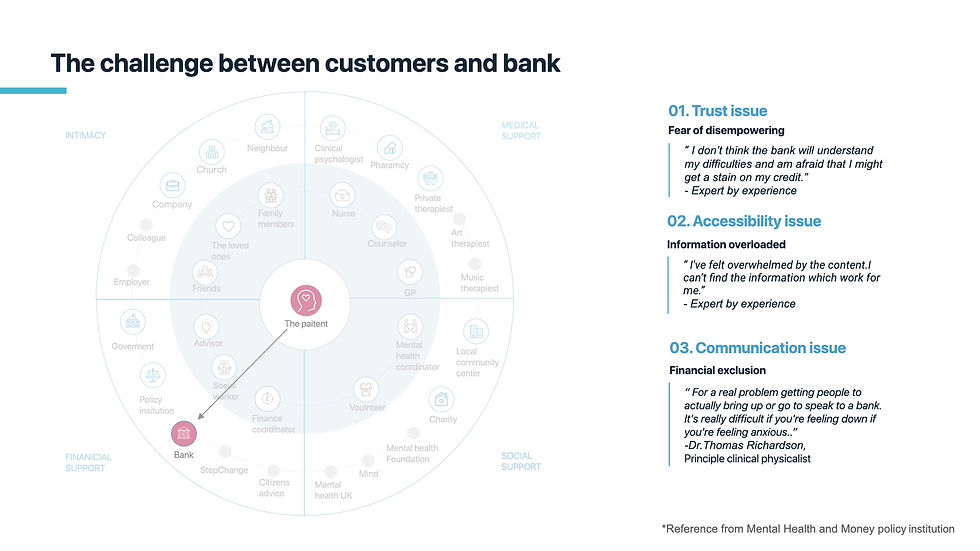

There are interaction issues between the traditional bank and the customers during the mental health journey.

HMW

How might we redesign the customer interaction in the high street banking app to provide end-to-end support on customers' mental health journey?

Customer segementation

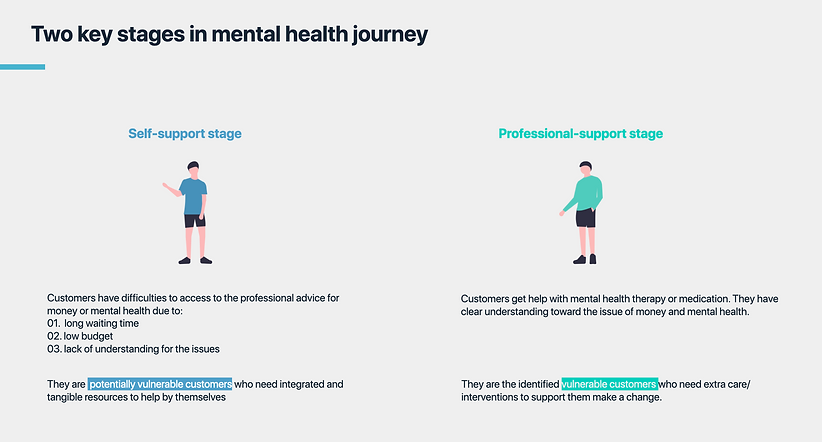

Since mental health problems are continuous and complex, in order to avoid disempowering customers, we define the boundaries of support and identify the customers by their behaviours and mental health support stages. With the consideration of mental health support journey, it typically are two stages called self-support and professional support. Therefore, we can group people into potentially vulnerable customer and vulnerable customers.

Insight summary

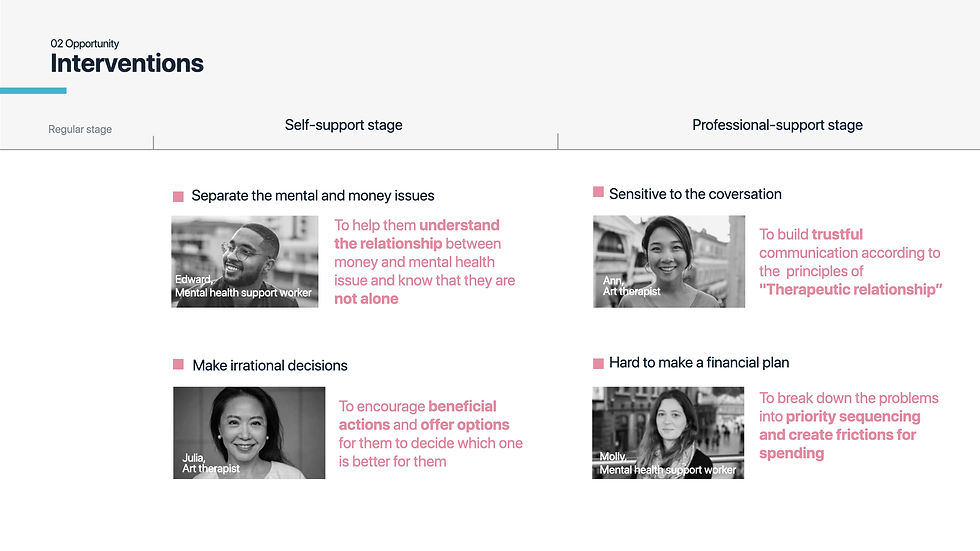

01. Customers should be grouped by their behaviours rather than the types of mental health problems.

02. The needs of financial support depends on their mental health support stage: : self-support and professional-support

03. All the different degree of difficulites come from the fear of losing control in life

What is Moneybuddy?

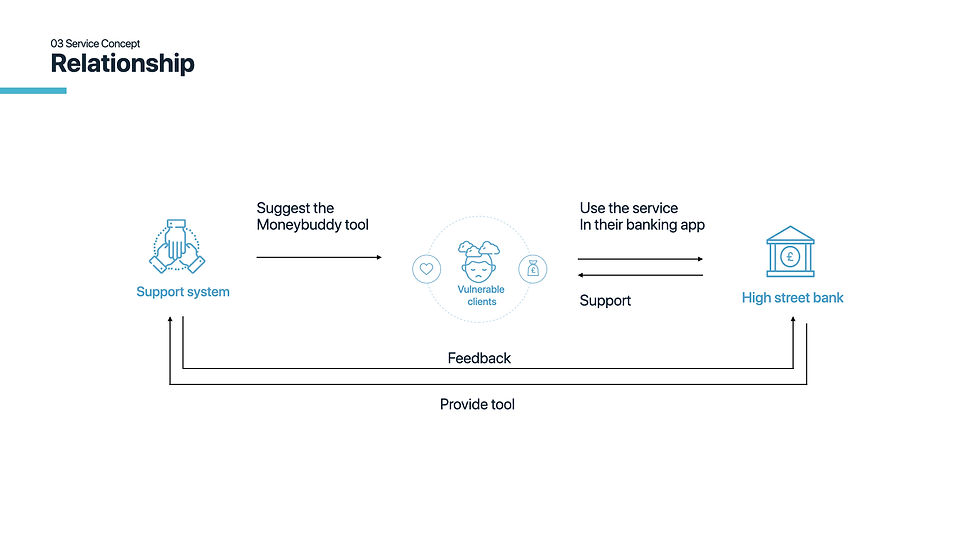

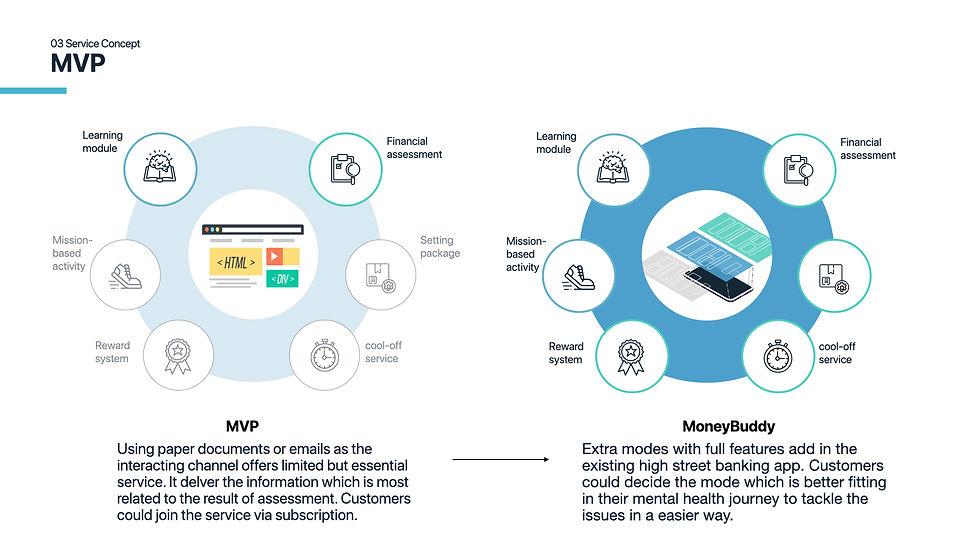

Moneybuddy is a digital banking service integrated to the current banking app that allows customers to reorganise their financial priorities and activate new banking modes based on their moods and mental health circumstances.

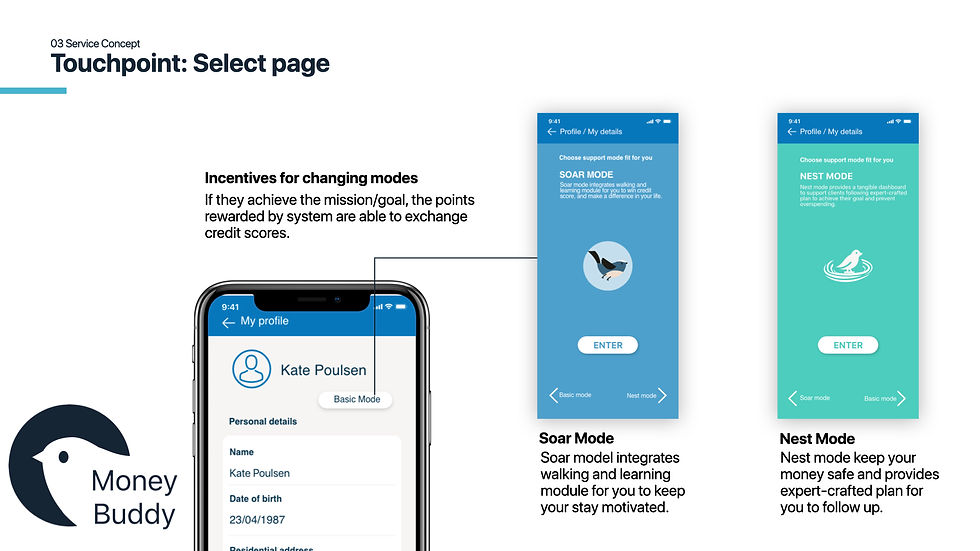

Service proposition

Aside from current interface mode provided by High street bank app, we design two extra modes, called Soar Mode and Nest Mode with extra features, to help vulnerable customers to go through different stage of difficulties.

Value proposition

Service details

(1) Soar mode:

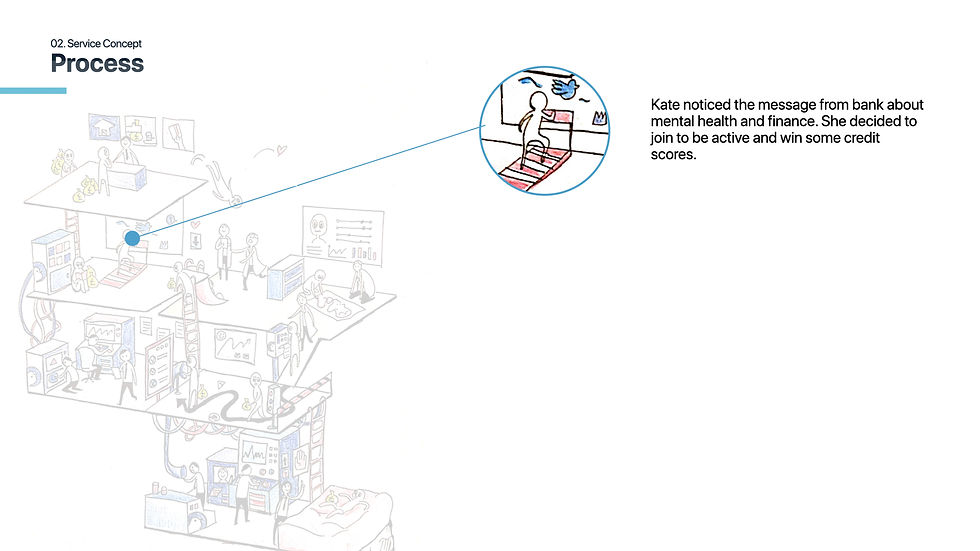

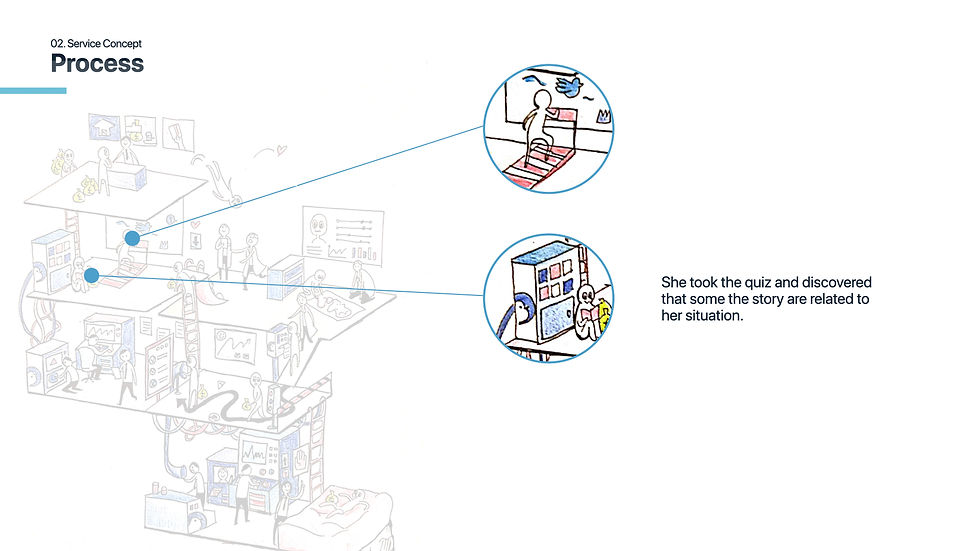

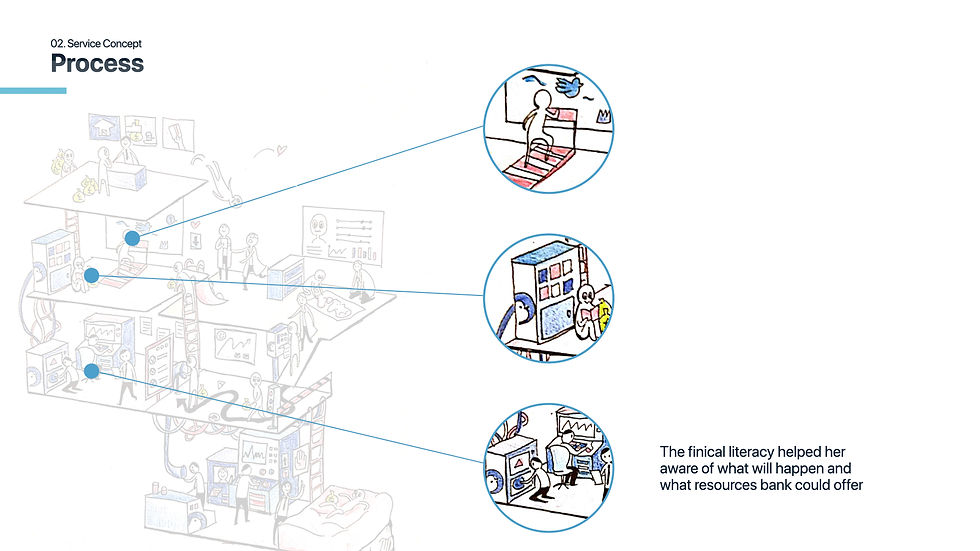

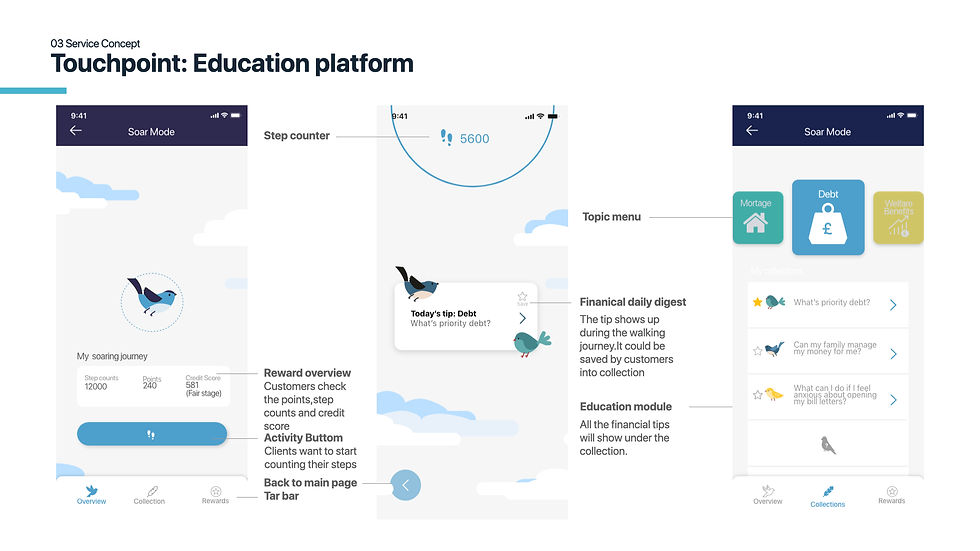

It is an integrated education platform to help vulnerable customers stay motivated. The role of banking is to support customers with inspiring. This mode aims to facilitate a better lifestyle and deliver support resources for customers to self-support. It creates a gamification experience for the learning module and activities module. You will meet a bird friend who will teach you financial literacy during the running journey.

(2)Nest mode:

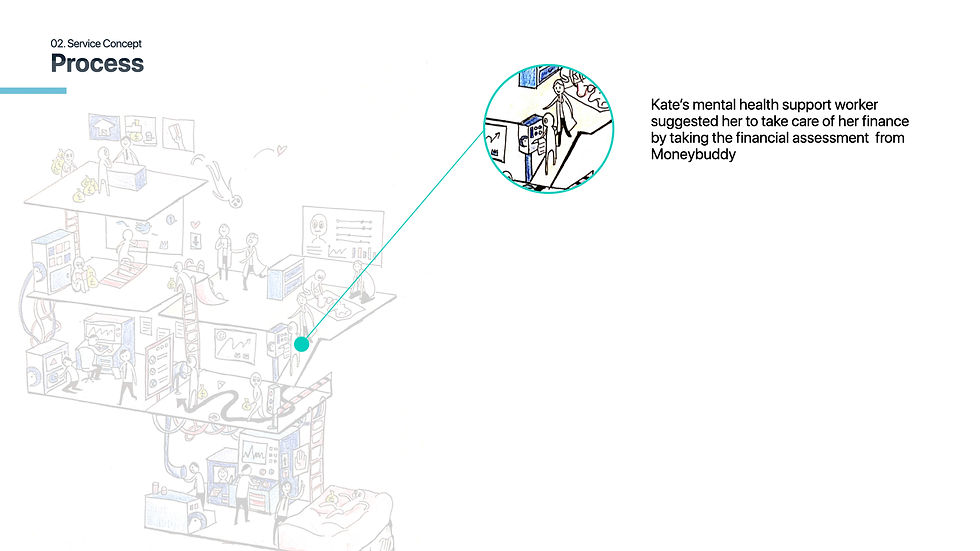

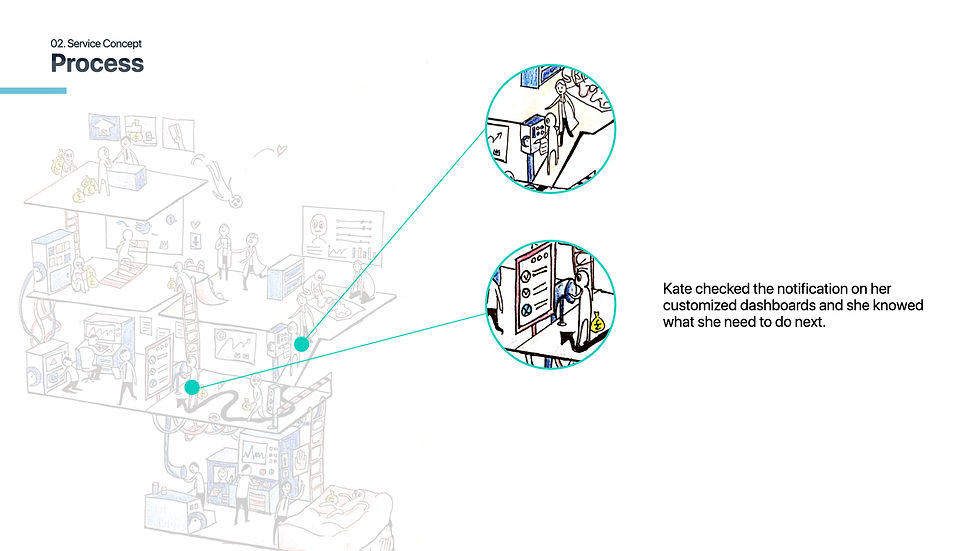

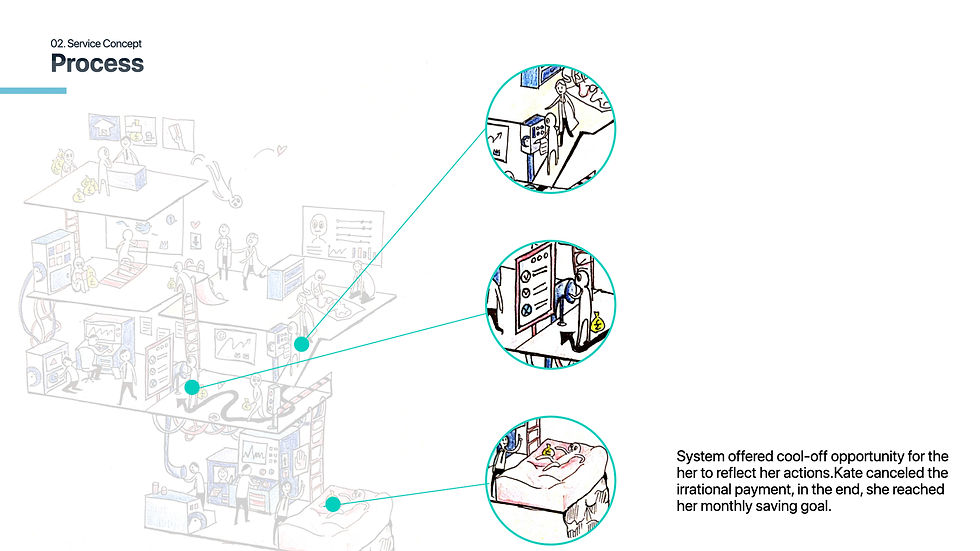

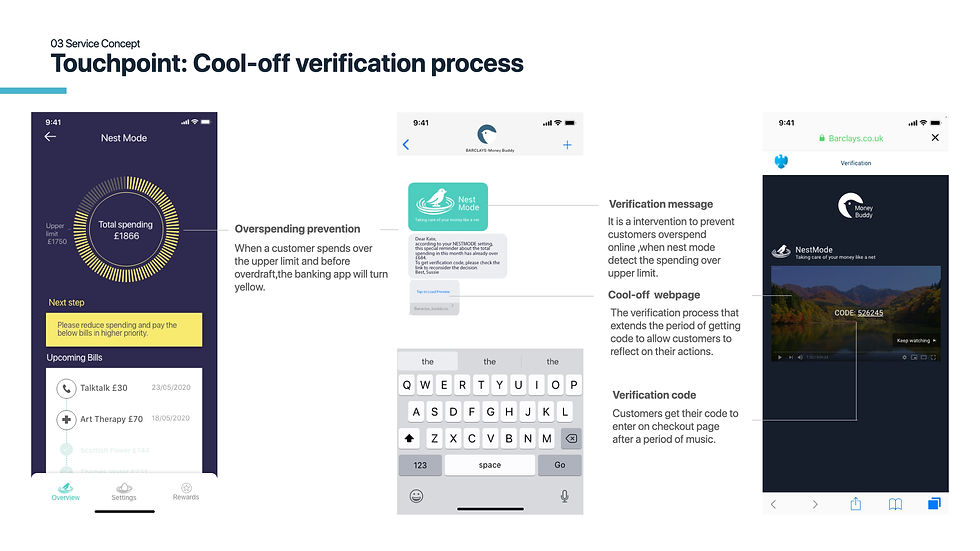

It is an expert-crafted financial tracker. The role of banking is to help customers to achieve their goal and prevent financial detriment. It supports the prevention of overspending and offers accessible and seamless support from the Moneybuddy team. It tailors service by financial assessment and allows people to reflect on their actions by the cool-off process. Nest mode is to help customers to easily to tackle both mental health problem and money problems at the same time.

Experience

UX/UI touchpoints

Impact and future

Modes create an opportunity for banking service to better shape the experience for customers in different scenarios. With the collaboration of mental health and financial support, it enables customers to tackle both problems at the same time. Moneybuddy could become a key toolkit and enable the bank to become one of the essential partners in the mental health support ecosystem.

Self-reflection to the project and the learning

Many thanks to the people I have cooperated with and the best mentoring from my tutor.

It was a long and challenging journey since the complexity of the mental health problem is complex and the limitation of the banking service. Through the process, I realized the contradictions between vulnerable customers and banks, struggles between rationality and sensibility. I tried to redefine the solutions which could show empathy toward their difficulties, and also reduce the risk of financial detriment. The challenges in this project I faced are identifying the customers and support boundaries. Putting myself into other's shoes helped me develop new opportunities for banking service beyond a single format.

After collecting feedback from concept testing and validation testing with experts by experience, the next steps for this project, I think is testing details of Nest mode with stakeholders and keep iterating it, such as the standard of the assessment and how traditional bank could work alongside local mental health service.